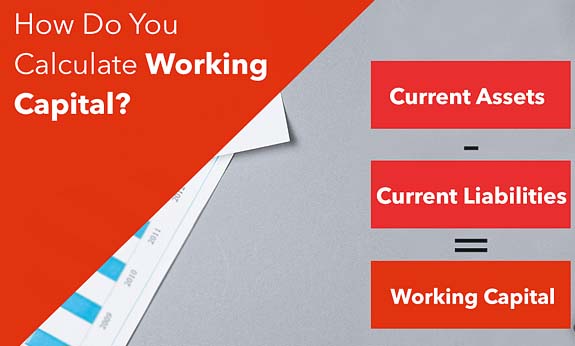

What Is Working Capital “Working capital is calculated by subtracting current liabilities from current assets” as listed on the company’s balance sheet. Current assets include cash, accounts receivable and inventory. Current liabilities include accounts payable, taxes, wages and interest owed.

Working capital is a financial metric calculated as the difference between current assets and current liabilities. Positive working capital means the company can pay its bills and invest to spur business growth.

Working capital management focuses on ensuring the company can meet day-to-day operating expenses while using its financial resources in the most productive and efficient way.

Importance of working capital

Liquidity perspective: By properly analyzing the expenses payable or be incurred in the near future the financial team of an enterprise would easily plan for their funds accordingly.

Out of Cash:

In-appropriate prepared plans of day to day expenses may result in enterprise liquidity issues. They have to postpone or to arrange funds from some other sources which give a bad impression of an enterprise at the party.

Helps in Decision Making:

By correctly analyzing the requirement of funds for day to day operations the finance team can appropriately manage the funds and can decide accordingly for available funds and for the availability of funds also.

Addition in the Value of Business:

As the management accordingly manages all the day to day required funds that help the authorized personnel to timely pay for all the outstanding creates a value addition or goodwill enhancement in the market.

Helps in the Situation of Cash Crunches:

By properly managing the liquid funds one can help the organization not to affect the situation of crises or cash crunches and pay for its day to day expenses on a timely basis.

Perfect Investments Plans: Correctly managing the funds or working capital one can choose or plan for their investments accordingly and invest the funds to maximize the return as per their availability.

Helps in Earning Short Term Profits:

Sometimes it is seen that the enterprises keep a heavy amount of funds as working capital which is far over and above the required level of working capital. So by correctly preparing the required working capital those extra funds could be invested for a short span of time and could create value in the profits of the enterprise.

Strengthening the Work Culture of Entity: Timely payment of all the day to day expenses mainly focused on the salary of the employees creates a good environment and a sort of motivation amongst employees to work harder and strengthening the good working environment.

Improves Creditworthiness of Entity:

When the enterprise has adequately planned their working capital requirements, they will surely pay the payments to vendors and other creditors timely which improves their creditworthiness which could help them to get the funds as and when required easily.

Act as Guarantor to Other Enterprises: When an enterprise has created such a good image in the market then the business could also help some other enterprises and in favor gets business profits and contracts done easily.

Good Reputation of Entity: Easy way to create a good reputation in the market which in turn helps the organization or entity in easily getting contracts because of a good image and fulfilling their commitments on time. Nowadays, everyone wants to deal and do business with such parties whose market reputation and creditworthiness is good due to an increase in fraud and manipulations.

Conclusion

To conclude the working capital in any business plays a crucial and vital role in achieving the organizational goal and enhancing the profitability of the business. The calculation of working capital may be done on monthly, quarterly or on yearly basis. Generally, it is preferred to calculate the working capital requirement and availability every quarter so that the further decisions could be taken accordingly as per the availability and requirements and the spare funds should be invested in such a manner so that the returns from the same could be maximized

see more