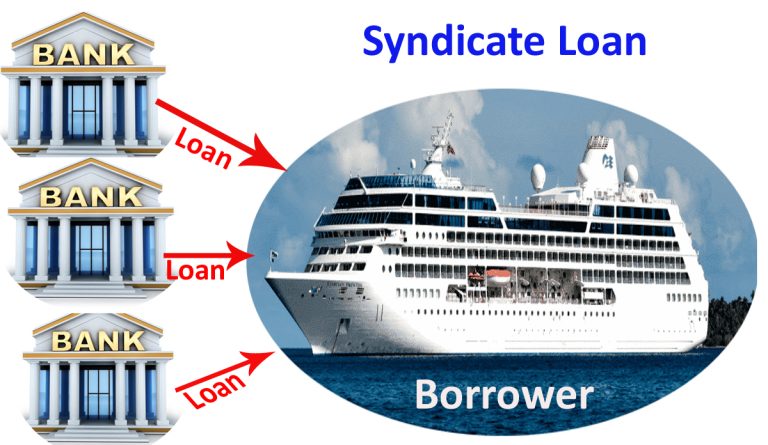

Loan syndications are often syndicated in order to avoided the risk among a large number of financial institutions. A loan syndicate is a group of several lenders. It may be a syndicated term loan, in which case the syndicate provides the borrower with a large amount of funds for a specified period of time, or it may be a syndicate of revolving loans, in this case the fund-providing institutions commit to lending the borrower a specified amount of money over a specified period of time.

Syndicate loan main theme

In a syndicated term loan, the credit is syndicated to a number of banks and finance companies, thus reducing the risk to any one institution. In a syndicated revolving loan, a group of banks and finance companies agree to lend the borrower a specified amount of money over a specified period of time.

The loan agreement gives the borrower the right to draw on the loan at any time during the period specified in the agreement. At the end of the specified period, the borrower must repay the loan in full. In a syndicated loan, the lead bank (or lead financial institution) is the institution that takes the lead in organizing the syndicate. The lead bank often takes a larger share of the loan than the other members of the syndicate.

What is the role of the lead lender in a loan syndication?

Loan syndication is a method of raising funds in which a group of lenders provide financing for a single loan or multiple loans. The lead arranger, typically a bank or other financial institution, negotiates the loan and coordinates the activities of the other lenders who are involved in the transaction. The lead lender in a loan syndication is the financial institution that negotiates the loan and coordinates the activities of the other lenders who are involved in the transaction. The lead lender typically provides a portion of the financing and may also serve as the agent for the syndicate

What is the difference between a loan syndicate and a loan syndication?

A loan syndicate is a group of lenders that provide financing for a single loan or multiple loans. A loan syndication is a method of raising funds in which a group of lenders provide financing for a single loan or multiple loans.

What is a lead arranger in a loan syndication?

A lead arranger is the financial institution that negotiates the loan and coordinates the activities of the other lenders who are involved in the transaction. The lead arranger typically provides a portion of the financing and may also serve

Advantage of syndicate loan

Syndication can be very effective in helping to achieve a business’s goals.

Syndication provides a source of capital.

Syndication provides an opportunity to grow a company’s customer base.

Syndication facilitates the sale of a company.

Syndication allows a company to expand its operations.

Syndication is a way to diversify a company’s customer base.

Syndication can be used to finance the purchase of another company.

Syndication can be used to finance the construction of a new facility.

Syndication can be used to finance the purchase of new equipment.

The syndication of a loan may create an opportunity for a prospective lender to gain an understanding of the financial condition of the borrower. The lender may require access to the borrower’s financial statements and tax returns, as well as information about the borrower’s business. The lender may also request a personal financial statement from the borrower. The lender may also require the borrower to provide collateral for the loan.

Way to get syndicate loan?

If you are interested in applying for a syndicate loan, you will need to contact a syndicate lender directly to discuss your options.

Conclusion

Loan syndication is the process of bringing together a group of lenders to provide financing for a borrower. The syndicate is typically composed of commercial banks, investment banks, insurance companies, and pension funds.

See More

What is supplier credit? Benefits and risk of supplier credit.