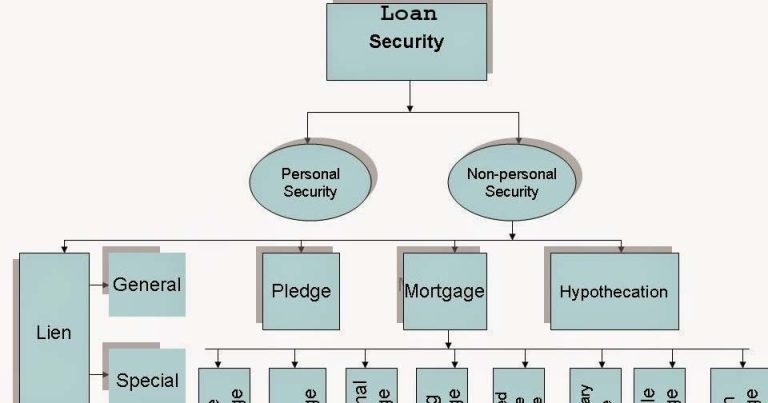

Different types of loan security, Security is something of value given to a lender by a borrower to support his or her intention to repay. In the case of a mortgage, the security is the property that the loan is being used to purchase. It may include tangible, intangible assets, or even a personal guarantee.

Different types of loan security for Bank Credit

Personal securities: When a bank lends to a borrower on the security of a third party. Then it is called lending on personal security. In the case of personal security, one has to look at the financial status, character, reputation, amount of debt, etc. of the guarantor. In the case of personal collateral, if the borrower is unable to repay the loan with interest on maturity, the guarantor is obliged to repay the loan. personal security consists of three parties. Such as: (1) Lender (Bank); (2) the borrower; (3) Guarantor. .

Non-personal Security

Non-personal security refers to movable and immovable tangible properties against which loans are granted. This type of security may include land, building, commodities, etc.

Non-personal security is safer than personal security. If the borrower defaults, the tangible property can be sold in the market to realize the unpaid amount. Non-personal security can be charged by pledge, mortgage, hypothecation, assignment , set off or lien.

1.Immovable Property: Banks often take security on various types of immovable property such as land, houses, buildings, etc. as collateral during the lending period. Before taking immovable property as collateral, the bank seriously considers the ownership, immunity and value of the property.

2. Goods and products as security: As a guarantee of loan repayment, banks often provide loans by mortgaging the goods or mortgaging the warehouse keys. In this case, even if the owner owns the product, the borrower can sell the product until the loan is repaid as the possession is with the bank.In this case, if the borrower fails to repay the loan, the bank can collect the loan money by selling the goods. The most advantage of such collateral is that the goods can be sold easily.

4. Marketable securities: Marketable securities such as exchange bills, shares, stocks, debentures, etc. are used as collateral for loans. These securities are very secure in modern loan system.

5. Documents: Debts with securities of modern goods as collateral for loans. Banks usually lend against the following documents. Such as- Carriage of imported goods, railway receipt, dock receipt, warehouse receipt, dock warrant, chartered party receipt etc. At the time of lending, the bank retains the imported goods of these documents and takes necessary action.

6. Valuable goods: Valuable goods such as gold ornaments, pearls, diamonds, etc. are often used as collateral for conventional loans. Disburses the loan amount within the stipulated time. The borrower returns the goods. In case of failure, the bank sells it and arranges for the recovery of the loan.

Perfect borrower selection loan cannot be turned into bad

What are mortgage documents? Types and process of mortgage.

Characteristics of good collateral:

→ Easy pricing capability

→ Warehousing capability.

→ Easy handling capability

→ Transportability

→ Durability / Sustainability

→ Ownership valuation capability

→ Easy exchange or easy transfer of ownership

→ Reliability. Liability.

→ Financial consistency.

immovable property with accumulated tax, house with rent etc. is not good as security.

Quality of personal security

Financial AbilityThe banker must inquire into the financial condition of the guarantor. If the guarantor does not have the financial solvency to repay the loan, the existence of a guarantee will be futile if the principal debtor defaults.

HonestyThe ability of the guarantor to repay the loan is of use only if the guarantor also has the willingness and integrity. So, in addition to the financial solvency of the surety, his honesty is of immense importance in case of personal guarantee.

Social statusThe social status of the borrower and that of the guarantor must be ensured before granting a loan. A person who holds esteemed kudos in society is more likely to be conscious about fulfilling his promises.

Quality of Non-personal Security

Acceptability

Asset accepted as security must be acceptable in the eyes of the law.

Marketability

The security must have a ready market. The bank has not taken the asset to keep it in its possession for an indefinite period but rather to sell it in the market and realize the loan amount

OwnershipBefore accepting security, the banker must ensure the ownership of the property. An asset that the lender does not own may render difficulty in getting the loan repaid. Moreover, if the title of the property is defective, the lender may face the problem.

AdequacyThe value of the security must be adequate to cover the full amount of the loan. Moreover, a reasonable margin over the (loan is to be maintained. The margin is the difference between the market value of the security offered and the loan granted.

LiquidityLiquidity refers to how quickly an asset can be converted into cash or other assets with little or no diminution in value. Ideally, security should be liquid, enabling the banker to sell l he properly at a known price as soon as the default occurs.

Stability of PriceThe price of the goods and commodities necessary for life are relatively stable over a short period, though not necessarily over a long period. But wide variations in the prices of luxury goods take place due to changes in demand, fashions, and tastes of the people.

Different types of loan security and What are the advantages of a secured loan for your business?

Secured finance represents a lower risk for the lender, because the asset ensures repayment in case of default. If the borrowed money cannot be repaid, the lender takes ownership of and sells the collateral.